Hi, Nathan Holmquist here. It's been a very long time since I last created a blog post. I'm going to kick-start this blog with a guest post by Peter Valley, of the website FBA Mastery.com, and founder of the Amazon repricing tool NeuroPrice. Take it away Peter…

How I got conned by a major Amazon repricer, performed a sting operation, and spent $70,000 to finally beat the repricing game.

I started out selling books on Amazon in 2007. Aka the Dark Ages. In those early days, Nathan’s blog Book To The Future was just about the only resource Amazon sellers had.

What I’ve learned in the years since is that the biggest challenge sellers face is not sourcing inventory, or customer returns, or all the things you hear sellers complain about in Facebook groups.

Quietly, the biggest challenge for Amazon sellers has always been repricing inventory.

In this story, I’m going to share my journey with repricing, how I lost a ton of money to a dishonest repricing company, and how I spent even more money to finally solve my biggest problem (and how you can solve your repricing problems as well).

My biggest Amazon selling epiphany

One of the earliest epiphanies I had is that success on Amazon comes down to only two things: Sourcing and repricing.

It really is that simple. You can neglect or completely mess up every other aspect of the business, and as long as you dial in sourcing & repricing, it’s impossible to not make money on Amazon.

So early on, I committed to focusing on sourcing and repricing only. I ignored accounting. Ignored returns, never chased down reimbursements, neglected opening investigations about lost FBA inventory, never knew my sell-through rate numbers, and ignored almost everything else. It was just sourcing and repricing, day in and day out.

In the early days, this was my schedule: Source inventory during the day. And reprice manually at night.

And this simplistic approach actually worked. Really well. But it also came with a huge problem…

My problems with Amazon repricing: The early days

So if Amazon businesses really come down to just sourcing and repricing, how did I address each one of these?

Sourcing challenges were easy. If I wanted more inventory, I just had to figure out either

- New places to get inventory, or-

- New methods of extracting more inventory from existing sources.

Pretty simple.

Repricing challenges are entirely different, and harder to fix.

As you probably know, there are three ways to reprice:

- Manually

- Using Amazon’s built-in repricer

- Using paid automated Amazon repricing software

In those early days, I was repricing everything manually. This becomes pretty challenging time-wise once your Amazon inventory grows above 100 SKUs. But I’m stubborn (and frugal) and I repriced manually with my inventory well into the thousands of books. Sounds insane, but I knew how sensitive repricing was, and I needed that control.

The process in those early days was excruciating, but there was one advantage: I could reprice with a level of precision in a way that wasn’t possible with repricing software.

But still, repricing manually took forever.

My journey with Amazon repricing: Graduating to software

Finally my Amazon book inventory hit 5,000 units in July of 2012, and it was too much. I signed up for an automated repricing tool (Scanpower, specifically).

The leap in sales was incredible. My sales roughly doubled. And it freed up a huge portion of my time. Win-win. I was hooked.

But the glory was short-lived. A few months later (September 1st, 2012 to be exact), Amazon quietly made a change so massive, it would set off another decade of repricing challenges for Amazon sellers everywhere.

The FBA data repricing apocalypse

Then the Big Data Apocalypse happened. The Dark Day of September 1st 2012. I forget where I heard about this change first (probably from this exact blog), but I know my repricing tool never admitted it. Both scanning apps and repricing tools were scrambling with how to deal with this event, and most quietly ignored it and hoped none of their users would notice.

The change was this:

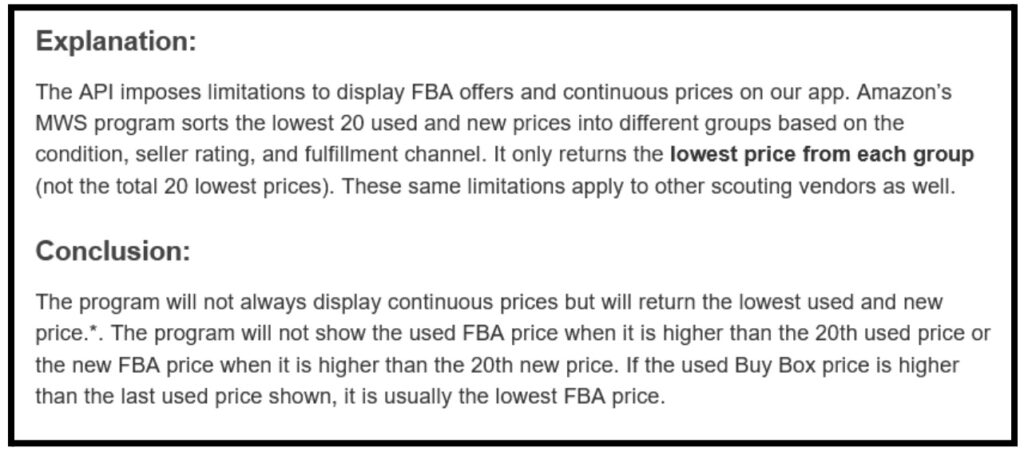

Amazon stopped sharing FBA prices with scanning apps and repricers if they were outside the lowest 20 offers.

Since FBA offers are usually priced higher than Merchant Fulfilled, and very often outside the bottom 20, this meant that a lot of FBA prices were suddenly invisible to apps and repricing tools.

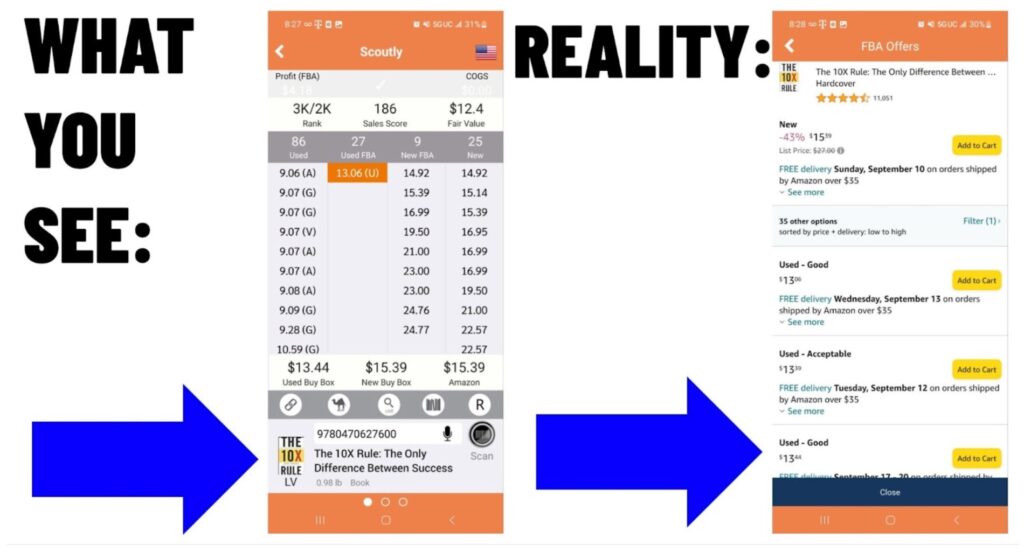

You could see this change instantly in scouting apps like Scoutly. The FBA column for many books would simply be blank. Then you’d click over to Amazon and find tons of FBA offers. The apps weren’t broken, it’s just that Amazon was no longer sharing a ton of FBA data.

With Amazon repricers, the problem was less obviously noticeable. Since repricers do their work behind the scenes, users probably didn’t even notice that their repricer was going haywire, mispricing items, or not repricing them at all.

For me, as an FBA seller, using a repricer that was now unable to “see” many competing FBA offers (and thus, unable to reprice my inventory) was out of the question. This would mean losing tons of money, either due to items not getting repriced, or getting repriced incorrectly due to this new FBA price limitation.

Just two months into using an automated repricer, I canceled my subscription. Back to repricing manually.

The FBA blindspot continues to this day, totally unknown to most Amazon sellers.

How serious is this “FBA blindspot”?

A few facts to consider:

- The percentage of books on Amazon that have its lowest FBA offer invisible to repricers and apps is impossible to quantify (and changes by the minute).

- The problem is serious, but less serious than it was in 2012 because FBA prices have come down.

- Among the tools that are honest about the existence of this blindspot, there’s varying estimates of how pervasive the issue is. One tool estimated that 80% of books have a competing offer in the blindspot, which I think is wildly overblown. But any number greater than 0% is still serious.

- Your repricing tool will never tell you when you have inventory impacted by the FBA blindspot (because it doesn’t know). You’ll quietly have mispriced or unpriced items, and won’t even know.

And then: a repricer that claimed it solved the blindspot

Jumping ahead a few years to 2015, I was talking to a seven-figure Amazon bookseller who faced the same problem that I (and everyone else) was facing. Only his stakes were higher, because his FBA inventory was so big there was simply no option of repricing it by hand.

He told me he’d been contacting founders of various automated Amazon repricing tools and had found one who claimed they were not affected by the FBA blindspot. The details were fuzzy, and my friend didn’t know exactly how they solved this, but he was confident they were telling the truth.

I wasn’t so sure. I went as far as talking to their lead developer, who assured me there was a 0% chance that their repricer had any FBA pricing blindspots. He wouldn’t explain how they were doing it, but after talking to him, I was hesitantly convinced. I signed up and turned over all my inventory to this repricer.

That was a mistake.

Lured into an Amazon repricer trap

My sales, of course, exploded again. My inventory was too big to be repricing all my inventory daily, so a lot of prices had been neglected and the automated repricer brought these items back to life.

It was the tail end of “textbook season,” which is basically Christmas for booksellers. The stakes were high, and sales were way up, but I started to wonder if perhaps I’d been too trusting with this repricing tool company.

So I decided to do an audit. I looked closely at exact repricing behavior, compared it to what was on the Amazon page, and realized something was seriously wrong.

Remember that textbooks – because of Amazon textbook buyers being heavily biased towards FBA offers – are the category most affected by the FBA blindspot. And as I did this audit, it was clear how bad the situation was.

It was impossible to quantify, but given my sales at the time, I could safely estimate my losses due to mispriced or un-repriced inventory to be in the thousands of dollars.

I vowed revenge on the Amazon repricing software industry

This sounds like the statement of a lunatic, but I was very bothered. I worked hard for my inventory, and to have it mishandled so badly was, to me, an unpardonable crime.

In the meantime, I went back to repricing by hand.

And I decided that one day, somehow, I was going to fix this problem. (Spoiler: I did. If you can’t wait until the end for the reveal, you can see it here.)

Why it’s crucial to understand how bad the repricing problem is

In the years since that textbook season incident, I’ve gone deep into researching the problems with Amazon repricers.

So far I’ve only talked about one issue (the “FBA blindspot”) but the problems with Amazon repricers is actually a lot worse than that.

I’ve signed up for most repricing tools out there. And I’ve learned about even more blindspots and inaccuracies affecting most (sometimes all) Amazon repricing tools. And the problem is even worse than I thought.

I’m going to share my findings from auditing most major repricing tools. It’s important to understand what I’m about to cover, because:

- You’re probably not going to read anything like this anywhere else.

- If you sell on Amazon, you’re either using a repricing tool or you will at some point.

The Top 6 problems with Amazon repricers, explained

#1: The FBA blindspot

If you’re an FBA seller, you simply can’t ignore this. You can try to look the other way, but you will get burned.

#2: Repricers can only reprice against the lowest offer

Ever notice how every repricer only lets you compare your price to the lowest price competitor? Why not the 2nd, or 3rd? When that would be strategic a huge portion of the time? This chains all your prices to the cheapest competitor, and forces prices down (instead of raising them). I call this the “bundle blindspot,” because it’s caused by another way that Amazon limits the data it shares with software tools: it “bundles” prices together into what it calls “pricing groups.” So software (like your scanning app) just sees these “bundles,” that may reflect either individual offers or multiple offers. Since your repricer can never know for sure which is the exact 2nd or 3rd lowest competitor, repricers don’t even offer this option. It’s actually kind of crazy how costly this blindspot is.

#3: No repricing based on Amazon Sales Rank

Sales Rank (aka BSR) is not included as an option for most repricers. In fact, I only found one (RepriceIt) that lets you use Amazon Sales Rank as a repricing criteria. Almost hard to believe how big of a liability it is to reprice an item ranked 5 million the same way as an item ranked 500. I would never use any repricer that didn’t offer this as an option.

#4: Repricers don’t allow repricing based on product category

Feels like common sense that you’d want to reprice categories differently from each other. For example, I reprice books totally differently than CDs. I couldn’t find a single repricer that offered this option.

#5: Repricers offer no option to review prices before committing

I was also unable to find one repricer that let me confirm it was repricing the way I wanted before those prices were locked in and live on Amazon. At a certain point you can trust your repricer settings are doing what you expect them to, but I didn’t find any repricer that let me do test runs and see my before / after prices before committing.

#6: Almost all repricers are impossibly complicated

The majority of repricers I tested are so pointlessly complex they are literally impossible to set up with any degree of confidence you’re doing it right. They’re out of control with their confusing settings, multiple pages of options, and features that are so poorly described it’s like learning a foreign language.There was no repricer I’ve used where I was confident I understood exactly how it would reprice my inventory in every scenario. If an experienced Amazon seller (i.e. me) signs up for your tool and can’t understand anything, that repricer has a serious problem. And that’s almost every repricer. Repricing should not be complicated.

(And if you want to talk about Amazon’s free, built-in repricer, the problems get even worse. I won’t even get into that subject.)

I could go on. But those are the top issues I see affecting every (or almost every) Amazon repricing tool.

How I solved the repricing tool problem: Phase One

I’ll admit that this first step I’m about to describe didn’t didn’t really “solve” anything, and probably looks more like petty trolling. But it did serve the purpose of educating the Amazon selling world on the scope of this “blindspot” problem.

Basically, I started by carrying out a sting operation on all major repricing tools. Let me explain…

When that repricing tool lied to me back in 2015, it revealed a big problem among Amazon repricers not revealing the limitations and shortcomings of their tools. They simply hope no one found out about the FBA blindspot (the “bundle blindspot” I talked about was impossible to hide, and no Amazon repricer even claimed it could price against the 2nd or 3rd lowest competitors).

So I set out to do an “honesty audit” (aka sting operation) to see how many repricing companies were honest about the FBA blindspot.

In simple terms, this took the form of emailing them and asking if their tool had any blindspots, and seeing if they responded honestly.

Here was the email I sent:

When faced with a direct question, how many would reveal the existence of the blindspot?

The results were worse than you’d think. The final tally was:

- Total Amazon repricers I contacted: 22

- Repricers I contacted who did not admit the blindspot: 15

- Repricers I contacted who admitted the blindspot: 2

- Repricers who didn’t respond: 5

(I won’t list all the guilty parties, but the repricers who were honest were RepriceIt, and Sellery. So hats off to them.)

This was starting to look like a real coverup in the Amazon repricing tool industry.

But of course, revealing the problem doesn’t solve the problem. The hardest part came next…

How I solved the repricing tool problem, Phase Two

I was actually going to have to fix the problems with Amazon repricers myself.

As I saw it, my fantasy Amazon repricer would do the following that no other repricer could do:

- Have no FBA blindspots.

- Allow you to price against the 2nd and 3rd lowest competitors – not just the lowest.

- Was centered around Amazon Sales Rank as the center of its repricing logic.

- Lets you reprice differently depending on the product category (for example, reprice Books differently than CDs).

- Lets you review all price changes before committing (if I wanted to).

- Worked inside of Amazon (vs some weird interface I have to learn from scratch).

- Be super ridiculously simple (all settings on one page and clearly described).

- Showing tons of data for sensitive inventory I wanted to reprice manually (price & sales history charts, and all competing offers without having to click).

All of this, along with the core options available in any repricer, with none of the weird complicated ones that didn’t matter to 99% of sellers.

Building my fantasy Amazon repricing tool

I don’t know how to write code. But I had built several software tools in the past by hiring developers to build ideas I essentially sketched on napkins. So I decided I’d have to do that again.

I’ll spare you all the chaos and tumult that followed. I hired developers. I fired developers. Some months progress was made. Sometimes we had setbacks that stalled us for months. We were bushwacking our way through uncharted territory, and it was intense.

I don’t even remember how long it took. At least 18 months. But in mid-2023 I had a working prototype of my dream repricer.

And I tried to forget it cost me $70,000 to get there.

Putting my fantasy Amazon repricer into action

There was no way I was going to keep this to myself forever, but I was going to use it privately for a while to test it out.

This repricer was amazing. Here’s how it worked:

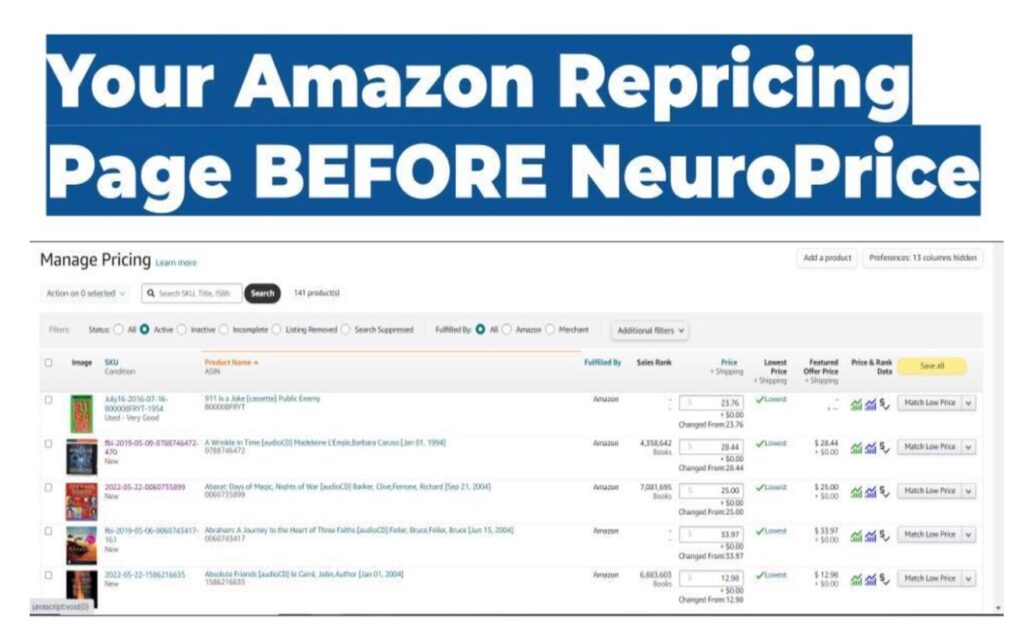

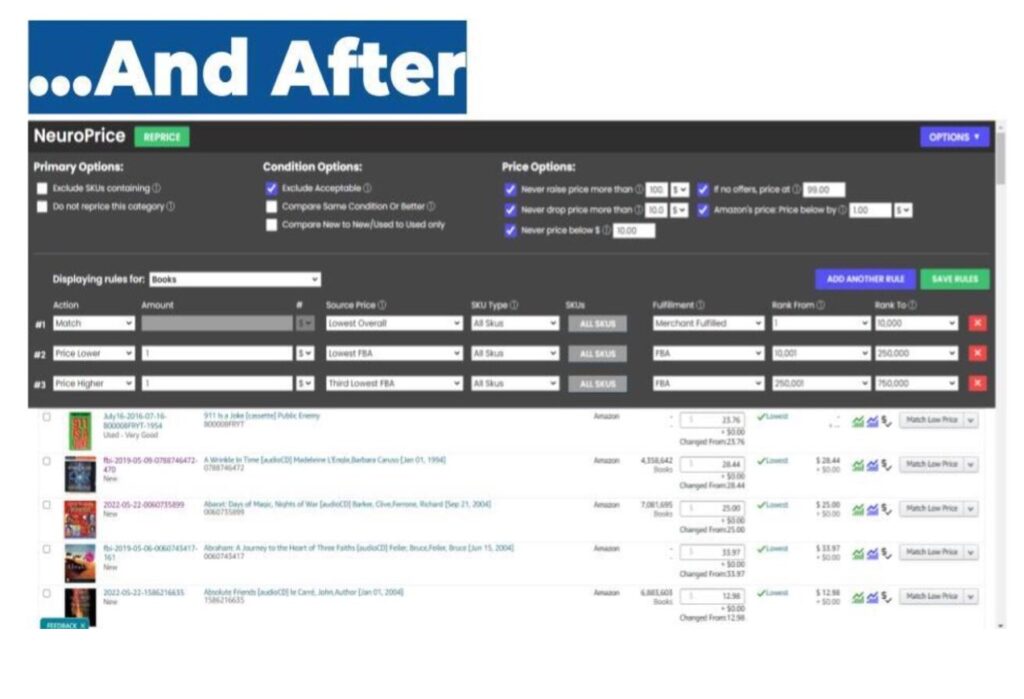

You install it in your browser. This was one of the weirdest parts of this new tool. I decided to make it a Chrome extension, instead of a web-based thing you had to log into. The repricer overlaid repricing controls directly on the Amazon “Manage Pricing” page inside Seller Central. Somehow no one had thought of this before.

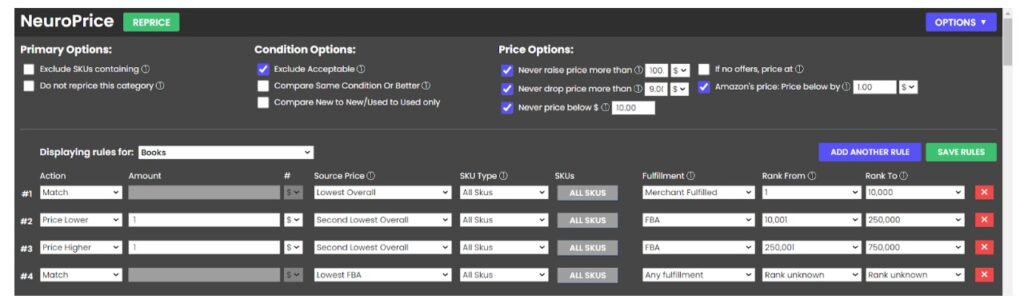

Set your repricing rules. This is where the magic really happened. We were able to get every setting into one simple interface. The early version looked like this:

All my fantasy settings and filters were there: Price against 2nd or 3rd lowest offers (with no blindspots) for either MF or FBA. Set repricing rules by Amazon Sales Rank. Set different rules by category. And review all prices before committing. And all of it was in a simple interface that took up less than half of the screen.

Hit “reprice.” It tore through my inventory repricing every item, showing the “before” price and the new price. And the precision was insane. It repriced like a laser. I could price (for example) 1 cent below the 3rd lowest FBA price if I wanted, or match the 2nd lowest, and just about any other above/below/match combo (Buy Box, etc). It was like an automated repricing mad scientist turned loose on my inventory.

If I wanted to review all prices before locking them in, I had that option. Or it would reprice my entire inventory automatically with one click. I had both options.

The only thing it didn’t do was fully automate my repricing in the form of setting a schedule I could just “set and forget.” I still had to click one button to reprice my entire inventory. Full automation was the dream, but I figured we could get to that later.

This thing was incredible. It just needed a name.

I called this new repricer NeuroPrice

And in July of last year, I released NeuroPrice to the world.

The response was basically what I expected. Here’s an example:

And others that went something like this:

Not to hype it up too much, but even with all its power, I still priced it among the three lowest priced repricers out there.

How to solve your Amazon repricing problems

You can start a free trial to NeuroPrice here:

Thanks to Nathan for letting me tell this story.

-Peter Valley

Peter Valley is the founder of NeuroPrice, and runs the website FBAmastery.com.

The ‘blindspot’ has always been explained to me as stemming from the fact that Simple Queue Service (SQS) limits the pricing data feeds (which every repricer I know of, other than Amazon’s own, acts upon) to the lowest 20 offers, regardless of fulfillment type.

Does this new repricer somehow act upon a dataset that isn’t the SQS-supplied lowest 20 offers?

Hi great article, ive been using channelmax and ive been loving it.

How does your customer support and repricer compare?